SBP Loan Scheme 2025 Registration Process and Loan Details

SBP Loan Scheme 2025 Overview

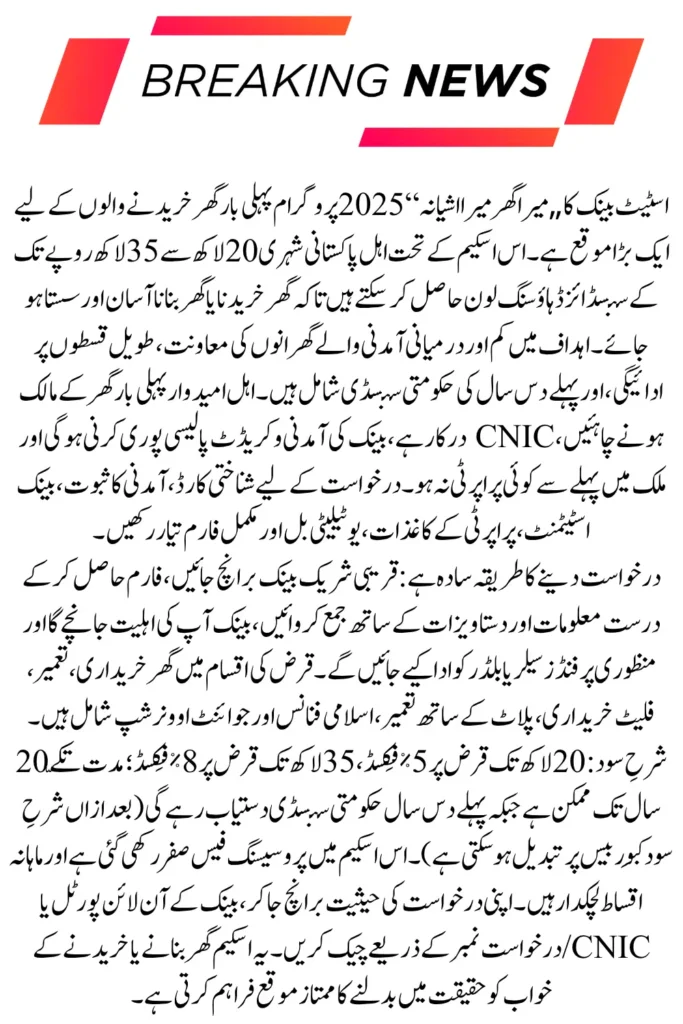

The SBP Loan Scheme, also known as the Mera Ghar Mera Ashiyana Scheme 2025, is a special housing program launched by the State Bank of Pakistan (SBP) for first-time homebuyers. Rising property prices have made it difficult for middle- and lower-income families to own homes, and this initiative helps them achieve their dream of homeownership with easy loans and low markup rates.

Through this program, SBP offers subsidized home loans with long repayment terms and low markup rates. It helps eligible citizens buy or construct their own house, flat, or plot, turning their dream of homeownership into reality.

What is the SBP Loan Scheme and Its Purpose?

The SBP Mera Ghar Mera Ashiyana Scheme is a government-backed home financing initiative. It offers loans ranging from PKR 2 million to PKR 3.5 million, making home buying more affordable and accessible.

The purpose is to support low- and middle-income families by giving them access to easy financing, long repayment plans, and zero processing charges. The government subsidy for the first 10 years further reduces the financial burden.

Who Can Apply for the SBP Loan Program 2025?

The scheme is open for first-time home buyers in Pakistan. Applicants must be Pakistani citizens with valid CNICs, meet income requirements, and apply within the loan value limit. Both salaried and self-employed individuals are eligible under this program.

Applicants must meet these key requirements:

- Must be a Pakistani citizen with CNIC

- Must be a first-time home buyer

- Property value within PKR 2M–3.5M range

- Meet bank’s income and credit policy

- Both salaried and self-employed accepted

- Must provide complete and true documents

- No existing home ownership in Pakistan

Required Documents for Loan Registration

Prepare the following documents before applying:

- CNIC of applicant

- Proof of income or salary slips

- Bank statement

- Property documents or seller info

- Recent passport-size photos

- Utility bill or address proof

- Completed loan application form

Step-by-Step Registration Process for SBP Loan Scheme

Follow these simple steps for quick registration:

- Visit nearest participating bank branch

- Ask for Mera Ghar Mera Ashiyana Form

- Fill with accurate details & attach documents

- Submit form for eligibility verification

- Bank reviews your income and property info

- On approval, loan is sanctioned

- Funds are disbursed to seller/builder

Types of Loans Offered Under SBP Scheme 2025

The scheme supports various housing needs:

- Home Purchase Loan – Buy a ready house

- Home Construction Loan – Build your own home

- Flat Purchase Loan – Buy an apartment

- Plot + Construction Loan – Buy land & build

- Islamic Home Finance – Shariah-compliant option

- Joint Ownership Loan – Husband-wife co-ownership

- Urban & Rural Schemes – For all areas

Interest Rate, Repayment Plan, and Loan Tenure Details

SBP offers subsidized markup rates with easy installments:

- 5% fixed for loans up to PKR 2 million

- 8% fixed for loans up to PKR 3.5 million

- Tenure: Up to 20 years

- Subsidy: First 10 years covered by govt

- Model: KIBOR with 3% after subsidy

- Zero Processing Fee

- Flexible Monthly Installments

How to Check Application Status After Submission

You can track your application through:

- Visit bank branch with CNIC

- Ask for application tracking

- Use bank’s online portal

- Enter application number or CNIC

- Get status update

- Contact loan officer for assistance

- Keep SMS updates saved for record

Final Words

The Mera Ghar Mera Ashiyana Scheme 2025 presents a golden opportunity for Pakistanis seeking to own their first home. With low markup, long tenure, no fees, and government subsidy, it’s designed to make homeownership simple and affordable.

Frequently Asked Questions

What is the SBP Loan Scheme 2025?

This is a government housing scheme under which first-time home buyers are provided easy loans at low mark-ups.

What is the loan limit?

A loan of Rs. 2 million to Rs. 3.5 million can be obtained under this scheme.

What are the documents required for application?

Identity card, income proof, bank statement, property papers, utility bills, and a completed form.

How to apply?

Visit the nearest participating bank branch, get the form, fill in the complete information and submit it along with the required documents.

How to check the application status?

Enter your CNIC or application number on the bank’s online portal or visit the branch to check the status.